While single-family home prices in Quebec’s recreational markets rose 16.1% year-over-year in 2022, inflation levels along with mortgage borrowing costs remain high, and are expected to drive values downward in 2023

Highlights:

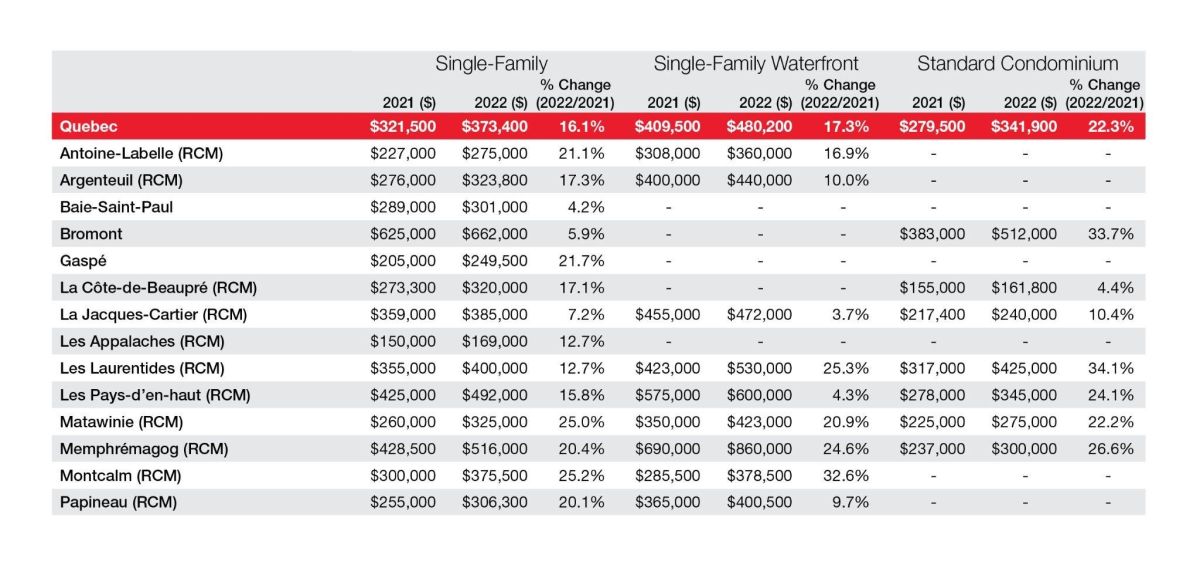

- The aggregate price of a single-family waterfront property in the province increased 17.3% year-over-year in 2022, while that of a condominium surged 22.3% during the same period.

- Markets in the Lanaudière region saw the highest median price gains in the province, given the relative affordability of properties.

- Bromont reported the highest prices in both the single-family home ($662,000) and condominium ($512,000) categories; Memphrémagog is the regional county municipality with the highest priced waterfront properties ($860,000).

- Conversely, the most affordable recreational regions are: Les Appalaches for single-family homes ($169,000); Côte-de-Beaupré for condominiums ($161,800) and Antoine-Labelle for single-family waterfront homes ($360,000).

- Royal LePage expects an 8.0% decline in the aggregate price of single-family homes in 2023 in the province’s recreational markets; the largest decline among Canadian provinces.

MONTREAL, March 28, 2023 – While interest rate hikes dampened real estate demand in the second half of 2022, property prices in recreational areas of the province of Quebec showed considerable appreciation compared to 2021, according to the Royal LePage 2023 Spring Recreational Property Report.

MONTREAL, March 28, 2023 – While interest rate hikes dampened real estate demand in the second half of 2022, property prices in recreational areas of the province of Quebec showed considerable appreciation compared to 2021, according to the Royal LePage 2023 Spring Recreational Property Report.

In 2022, the aggregate price of a single-family home in the province’s surveyed recreational markets increased 16.1% year-over-year to $373,400. During the same period, the aggregate price of a single-family waterfront property rose 17.3% to $480,200, while that of condominiums was up 22.3% to $341,900.

Among the recreational areas studied, Lanaudière saw the strongest increase in the median price for a single-family home, rising approximately 25% in both Montcalm and Matawinie, to $375,500 and $325,000, respectively. In the condominium market, Les Laurentides RCM and Bromont finished in a dead heat with a 34% increase in the median price, reaching $425,000 and $512,000, respectively. Lakeside and riverside properties also saw increases, especially in Montcalm, where the median price surged 32.6% to $378,500.

In a survey of Royal LePage recreational property experts across the province,[1] a large majority of real estate brokers (77%) said they are seeing less buyer demand in their respective markets right now, compared to the same time last year. On the other hand, 53% of respondents said there are less properties for sale compared to the same time last year. In terms of selling time, 82% of recreational property experts believe that the number of days a property remains on the market has increased. Of those, 50% say the selling time has increased slightly, while 32% say it has increased significantly.

Forecast

Royal LePage expects the aggregate price of a recreational property in the province to decline by 8.0% in 2023 compared to the previous year, to $343,528. In its analysis, Royal LePage expects that in 2023, recreational markets will be the most heavily impacted by the price correction in the province, compared to urban markets, due to the unprecedented demand caused by the pandemic housing boom. In addition, many of the real estate markets surveyed are already seeing a decrease in prices since the beginning of the year, compared to the same period in 2022.

Although inflation and increasing mortgage costs have cooled demand for recreational properties over the past year, the lifting of public health restrictions has eased potential buyers’ sense of urgency and led them to narrow their property search criteria according to their budget. Homeowners whose mortgage loans are nearing renewal may be prompted to reassess their situation. Some buyers may put purchasing a secondary home on hold until interest rates come back down and inflation is brought under control. On the other hand, discretionary spending on travel outside the country is common once again after a few years of restrictions, and for some this may put a cottage purchase lower on their list of priorities.

The recreational property market is expected to remain balanced in 2023, but this balance could shift in favour of buyers if the Bank of Canada were to reduce its overnight lending rate, stimulating housing demand. Conversely, if rates rise again, households will have less financial capacity, causing a more pronounced downward adjustment in property prices. The supply of properties for sale might therefore increase more significantly compared to 2022. Buyers will enjoy a more varied selection of properties in 2023, as well as improved negotiating power. As for sellers, while the market value of their property may decrease, they will still benefit from an average profit of 35% compared to 2020 property prices.

Regional analyses

Laurentides

Pays-d’en-Haut and Les Laurentides RCM

In 2022, the median price of a single-family home in the Pays-d’en-Haut region increased 15.8% year-over-year, to $492,000. In the neighbouring Les Laurentides RCM, the price appreciation for the same property type over the same period was 12.7%, with the median price reaching $400,000. The median price of a condominium property in Pays-d’en-Haut and Laurentides, meanwhile, rose by 24.1% and 34.1% respectively, to $345,000 and $425,000. During the same period, price trends for waterfront properties diverged from one region to another: the median price in Pays-d’en-Haut was up 4.3% to $600,000, while in Laurentides it soared 25.3% to $530,000.

“We are in a two-speed market with sharply contrasting scenarios,” said Éric Léger, a chartered real estate broker with Royal LePage Humania. “On one hand, the inventory of properties for sale is steadily increasing and so is the number of motivated sellers willing to lower their asking price. But on the other hand, we’re seeing multiple-offer situations with properties that are ideally located, well-maintained and listed at a fair price,” he continued. “It can be challenging for consumers to stay on top of the market trends because we’re still in a transition. Over the next few months, owners of secondary homes in the region may need to rethink their priorities as their mortgages come up for renewal at substantially higher interest rates.”

Léger also noted that the spring market in the area may be less buoyant this year because of the current economic uncertainty. But, he adds, demand in the lower price ranges will remain strong.

Estrie

Bromont and Memphrémagog

In 2022, the median price of a single-family home in Bromont rose 5.9% year-over-year to $662,000. In neighbouring Memphrémagog, during the same period the increase was 20.4%, with the median price reaching $516,000. The median price of a condominium in Bromont and the RCM of Memphrémagog, meanwhile, jumped by 33.7% and 26.6% respectively, to $512,000 and $300,000. Median price increases for waterfront properties in Memphrémagog during the same period increased by 24.6%, to $860,000, the highest value of all the recreational regions surveyed. Lake Memphrémagog is renowned for its luxury properties.

“The real estate market in the Eastern Townships today is vastly different from what we saw during the past three years,” explained Véronique Boucher, a residential real estate broker with Royal LePage Au Sommet. “Buyers are more patient; they’re negotiating and they’re taking time to carefully assess their needs and their financial capacity before taking the plunge. Conditional offers to purchase, which were practically unheard of during the pandemic real estate boom, made a big comeback in the latter half of 2022, a sign of a much more balanced and fair market.”

“Sellers are affected as well, because although property values remain high, they are having to adjust to negotiating. Multiple-offer and overbidding scenarios are no longer the norm, but they are still happening when the property is priced right and it’s a turnkey deal.”

Boucher expects prices in the Eastern Townships region to ease in 2023 compared with 2022, especially in Bromont, where market values for properties have peaked.

Lanaudière

Montcalm and Matawinie

In 2022, the median price of a single-family home in the Montcalm and Matawinie RCMs, in Lanaudière, rose 25.2% and 25.0% year-over-year, to $375,500 and $325,000, respectively. During the same period, waterfront properties saw their median price increase to 32.6% and 20.9% respectively, to $378,500 in Montcalm and $423,000 in Matawinie. On the condominium market in Matawinie, the median price for a unit was up by 22.2% in 2022 compared to 2021, reaching $275,000.

“The main reason why prices in the Lanaudière region have continued to rise more sharply than elsewhere in the province is that properties here remain affordable,” notes Éric Fugère, a residential real estate broker with Royal LePage Habitations. “In spite of the market downturn and recent interest rate hikes, buyers are still very present and keen to seize opportunities in the region. Some sellers, meanwhile, are looking to get a high price and are prepared to be patient, which is one thing keeping the number of properties on the market from growing.”

Fugère believes that the market for recreational properties will react more slowly to the rebalancing of prices than the residential market, and that prices for these properties in Lanaudière will decline modestly.

Capitale-Nationale

La Côte-de-Beaupré RCM and La Jacques-Cartier RCM

In 2022, the median price of a single-family home in the RCMs of La Côte-de-Beaupré and La Jacques-Cartier, in the Capitale-Nationale region, increased by 17.1% and 7.2% year-over-year, to $320,000 and $385,000 respectively. During the same period, the median price in the condominium segment in La Côte-de-Beaupré rose 4.4% to $161,800, the lowest in any of the recreational regions surveyed. The median price for a lakefront or riverfront property in La Jacques-Cartier was up slightly by 3.7%, to $472,000.

“The big challenge in the 2023 real estate market will be financing,” points out Marc Bonenfant, a residential and commercial real estate broker with Royal LePage Inter-Québec. “Many buyers have had to narrow their property search criteria to be able to get a pre-approved mortgage, or have simply put their plans on the back burner. Demand remains strong in the resort regions near Quebec City because the number of properties available for sale is still very low. I’m also seeing enthusiasm for properties that allow short-term rentals, but given that the down payment for this type of property is much higher, you need a solid financing case to secure a loan.”

According to Bonenfant, the household debt load, compounded by rising inflation and higher borrowing costs, will lead to a more significant adjustment in recreational property prices in 2023 than in 2022.

Data chart – Recreational Property Prices (2022) and 2023 forecast: rlp.ca/table_2023springrecreationalpropertyreport

Data chart – Recreational Property Prices (2022) – Province of Quebec:

List of Royal LePage recreational property experts in Quebec:

Antoine-Labelle

Jessica Vaillancourt, Residential Real Estate Broker

Royal LePage Humania

jvaillancourt(at)royallepage(dotted)ca

819.808.9807

Argenteuil

Pierre Vachon, Residential and Commercial Real Estate Broker

Royal LePage Humania

pvachon(at)royallepage(dotted)ca

514.512.1598

Baie-St-Paul

Jean-François Larocque, Residential and Commercial Real Estate Broker

Royal LePage Inter-Québec

jfl(at)royallepage(dotted)ca

418.635.1191

Gaspé

Christian Cyr, Residential and Commercial Real Estate Broker

Royal LePage Village

christian(dotted)cyr(at)royallepage(dotted)ca

418.392.9927

La Jacques-Cartier and Côte-de-Beaupré

Marc Bonenfant, Residential and Commercial Real Estate Broker

Royal LePage Inter-Québec

marcbonenfant(at)royallepage(dotted)ca

418.561.3918

Laurentides and Pays d’en Haut

Éric Léger, Residential and Commercial Real Estate Broker

Royal LePage Humania

eric(at)ericleger(dotted)com

514.949.0350

Les Appalaches

Mélissa Roussin, Residential and Commercial Real Estate Broker

Royal LePage Pro

mroussin(at)royallepage(dotted)ca

418.333.2214

Matawinie and Montcalm

Éric Fugère, Residential and Commercial Real Estate Broker

Royal LePage Habitations

ericfugere(at)royallepage(dotted)ca

514.799.2847

Memphrémagog and Bromont

Véronique Boucher, Residential Real Estate Broker

Royal LePage Au Sommet

veroniqueboucher(at)royallepage(dotted)ca

450.525.2318

Papineau

Annick Fleury, Residential Real Estate Broker

Royal LePage Vallée de l’Outaouais

annick(at)equipefleury(dotted)ca

819.592.5152

About the Royal LePage Recreational Property Report

The Royal LePage Recreational Property Report compiles insights, data and forecasts from 14 markets in Quebec. Median price data was compiled and analyzed by Royal LePage using Centris for the periods between January 1, 2021, and December 31, 2022, and January 1, 2020, and December 31, 2021. Royal LePage’s aggregate home price is based on a weighted model using median prices. Data availability is based on a transactional threshold and whether regional data is available using the report’s standard housing types. Aggregate prices may change from previous reports due to a change in the number of participating regions.

About the Royal LePage Recreational Property Advisor Survey

A provincial online survey of 34 real estate brokers serving buyers and sellers in recreational areas across Quebec. The survey was conducted between March 1 and 18, 2023.

About Royal LePage

Serving Canadians since 1913, Royal LePage is the country’s leading provider of services to real estate brokerages, with a network of approximately 20,000 real estate professionals in over 650 locations nationwide. Royal LePage is the only Canadian real estate company to have its own charitable foundation, the Royal LePage Shelter Foundation, which has been dedicated to supporting women’s shelters and domestic violence prevention programs for 25 years. Royal LePage is a Bridgemarq Real Estate Services Inc. company, a TSX-listed corporation trading under the symbol TSX:BRE. For more information, please visit https://www.royallepage.ca.

For more information, please contact:

Maria Bello Vega

North Strategic on behalf of Royal LePage

maria(dotted)bellovega(at)northstrategic(dotted)com

514.713.6577